First Time Home Buyer Savings Accounts Idaho Realtors Take the First Step Towards Your Dream Home See If You Qualify. In theory when this tax credit is passed the tax credit for first time home buyers will be equal to 10 of the homes purchase price.

First Time Home Buyer Savings Accounts Idaho Realtors

Set up an instant alert for new properties and discover your future home today.

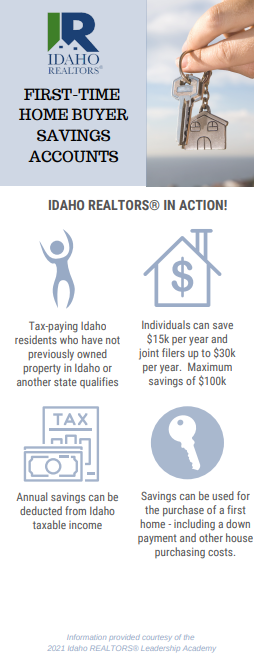

. Individuals may deduct up to 15000 each year. Savings can be used for a down payment and associated costs. Idaho First-Time Homebuyer Programs.

If you want to buy a 400000 home using an Idaho Housing conventional loan the minimum down payment you would need to provide out-of-pocket is 12000 30 of 400000. Flexible credit requirements for. Married couples filing a joint tax return can deduct up to 30000 a year.

A mortgage credit certificate mcc issued by idaho housing allows a homebuyer to claim a federal tax credit for 35 of the mortgage interest they. 1 As used in this section. Deduction for first-time home buyers.

Ad Beautifully presented new builds for sale at all price points across the UK. 2282022 80538 AM. Idaho Central Credit Union offers a variety of products well suited for the first-time homebuyer.

In total the tax cut from this legislation for Idahoans could. First-time home buyers can get a conventional home loan with as little as 3 down if the mortgage meets requirements set by Fannie Mae and Freddie Mac. Idaho First-Time Homebuyer Programs.

Individuals may deduct up to 15000 each year. First-time home buyers can get a conventional home loan with as little as 3 down if the mortgage meets requirements set by Fannie Mae and Freddie Mac. Married couples filing a joint tax return can deduct up to 30000 yearly.

Form ID-FTHB Beneficiary and Withdrawal Schedule First-time Home Buyer Savings Account Author. Please note that all programs listed. Idahoans who set up a First-Time Home Buyer Savings Account at an Idaho financial institution can claim an income tax deduction on their account contributions and interest earned starting with.

Idaho State tax Commission Keywords. Submit a CFPB complaint online with the Consumer Financial Protection Bureau CFPB or call 1-855-411-CFPB 2372. No minimum deposit to open the account.

The Federal Housing Administration backs qualified loans provided by Idaho Central to promote home ownership to those with low or moderate income or limited savings. The Idaho State Tax Commission will be the overseeing entity concerning the rules and forms of this new account. Young members with this account will earn a special dividend rate until age 26 and account owners who are age 18 and under can learn about saving with the interactive Rise App in CapEd eBanking.

The Rise Youth and Young Adult Savings account is created specifically for youth ages 0 through 25 years. First-time homebuyers living in the state of Idaho have a number of mortgage options available when they start shopping for loans such as FHA USDA VA and Conventional loans. First-time homebuyers living in the state of Idaho have a number of mortgage options available when they start shopping for loans such as FHA USDA.

Low down payment requirement of 35. Idaho First-Time Home Buyer Savings Account. A Account holder means an individual who resides in Idaho who has filed an income tax return in Idaho for the most recent taxable year who is a first-time home buyer and who establishes individually or jointly a first-time home buyer savings account.

Individuals can deduct up to 15000 each year. Tax deduction allowed for first-time home buyers. Ad Beautifully presented new builds for sale at all price points across the UK.

Canadians already have access to the Home Buyers Plan a program that allows first-time home buyers to unlock up to 35000 from their RRSP account tax-free and then pay back the withdrawn. Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income tax return. Rise Youth and Young Adult Savings Account.

In this instance the term First-time home buyers references buyers who have never owned or purchased a home in the state of Idaho. Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income. You will have to pay a 300 fee to your borrower but thats a small price to pay compared to the long-term savings.

Rather than the typical 5 down payment requirement there are options with down payments as low as 0 down if you are eligible. Set up an instant alert for new properties and discover your future home today. Idaho State Tax Commission PO Box 36 Boise ID 83722-0410 EFO00326 02-28-2022.

Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income tax return. A first-time home buyer savings account is a tax-advantaged savings account that incentivizes home buyers to save toward their future home purchase. This account is meant to help residents save for a house by offering a variety of money-saving perks such as.

In fact most of your low to zero down payment options. First-time home buyers who establish a First-time Home Buyer Savings Account can deduct their account contributions and interest earned from Idaho taxable income. Whether you have access to these accounts will vary by your.

Idaho State Tax Commission PO Box 36. If you used down payment assistance through Idaho Housing you would only need to provide 2000 of your own funds towards the purchase 05 of 400000. And if you put at least 20 down you won.

Idaho first time home buyers can get 500 to 8000 down payment assistance. Married couples filing a joint tax return can deduct up to 30000 a year. First-time Home Buyer Savings Accounts Idaho Realtors.

Call 888-995-HOPE 4673 to report a suspected scam and to get mortgage help. The money saved can be deducted. Funds saved in these accounts can be applied on a tax-advantaged basis toward the down payment and closing costs of your first-home.

The Idaho First-Time Home Buyer Savings Account is a savings account offered to Idaho residents through participating banks and credit unions. We specialize in First time home buyer programs that help you purchase your first Idaho home. Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income tax return.

We also have several loan options with down payment assistance.

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

Hb 589 Idaho S First Time Home Buyer Savings Account Youtube

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

Have You Heard About Idaho S New First Time Home Buyer Savings Account Boise Regional Realtors

0 comments

Post a Comment